UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [X]

Filed by a party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

[X ]X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

GOLDEN QUEEN MINING CO. LTD.

(Name of Registrant as Specified In Its Charter)

___________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| (1) | Title of each class of securities to which transaction applies: |

| N/A | |

| (2) | Aggregate number of securities to which transaction applies: |

| N/A | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth |

| the amount on which the filing fee is calculated and state how it was determined): | |

| N/A | |

| (4) | Proposed maximum aggregate value of transaction: |

| N/A | |

| (5) | Total fee paid: |

| N/A | |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1

| (1) | Amount Previously Paid: |

| N/A | |

| (2) | Form, Schedule or Registration Statement No.: |

| N/A | |

| (3) | Filing Party: |

| N/A | |

| (4) | Date Filed: |

| N/A | |

2

GOLDEN QUEEN MINING CO. LTD.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS6411 IMPERIAL AVENUETO BE HELD AT 10:00 A.M. ON JUNE 23, 2011

The 2011 Annual General Meeting of Shareholders of Golden Queen Mining Co. Ltd. (the “Company”) will be held at 10:00 a.m. (Pacific Standard Time) on Thursday, June 23, 2011 at Suite 1200 - 750 West Pender Street, Vancouver, British Columbia, V6C 2T8, for the following purposes:

| 1. | To receive the financial statements of the Company for its financial year ended December 31, 2010 together with the report of the independent auditors thereon; |

| 2. | To fix the number of directors at five; |

| 3. | To elect directors to serve until the next Annual General Meeting of Shareholders or until their respective successors are elected or appointed; |

| 4. | To ratify the appointment of BDO Canada LLP as independent auditors of the Company for the financial year ended December 31, 2011; and |

| 5. | To transact any other business which may properly come before the Meeting, or any adjournment or postponement thereof. |

The board of directors has fixed May 2, 2011, as the record date for determining shareholders entitled to receive notice of, and to vote at, the Meeting or any adjournment or postponement thereof. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the Meeting.

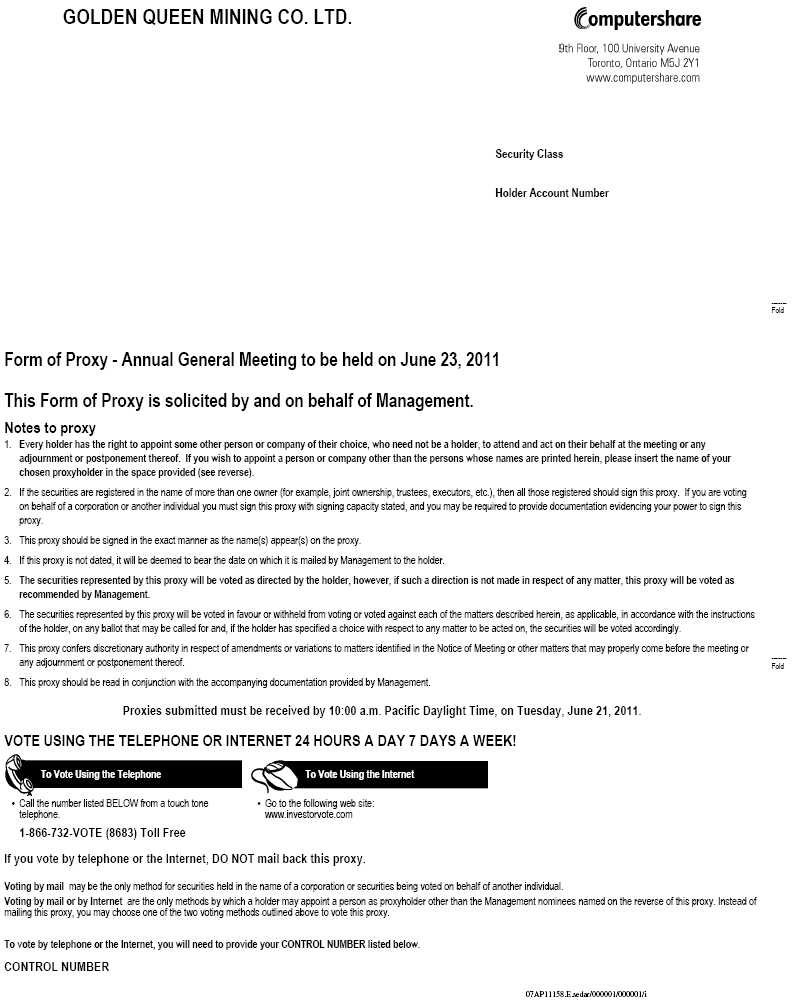

All shareholders are invited to attend the Annual General Meeting in person, but even if you expect to be present at the meeting, you are requested to mark, sign, date and return the enclosed proxy card as promptly as possible in the envelope provided to ensure your representation.All proxies must be received by our transfer agent not less than forty-eight (48) hours, excluding Saturdays, Sundays, and holidays,prior to the time of the meeting in order to be counted.The address of our transfer agent is as follows: Computershare Trust Company of Canada, Proxy Dept., 100 University Ave., 9thFloor, Toronto, ON, M5J 2Y1. Shareholders of record attending the Annual General Meeting may vote in person even if they have previously voted by proxy.

Dated at Vancouver, British Columbia, this 24thday of May, 2011.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ H. Lutz KlingmannWEST VANCOUVER, BC V7W 2J5H. Lutz Klingmann

President and Director

Important Notice Regarding the Availability of Proxy Materials for

the Company’s Annual Meeting of Shareholders on June 23, 2011.

The Golden Queen Mining Co. Ltd. Proxy Statement and 2010 Annual Report to Shareholders

are available online at www.goldenqueen.com

3

GOLDEN QUEEN MINING CO. LTD.

PROXY STATEMENT AND INFORMATION CIRCULAR

SPECIALANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD SEPTEMBER 1, 2010JUNE 23, 2011

In this Proxy Statement and Information Circular, all references to “$” are references to United States dollars and all references to “C$” are references to Canadian dollars. As at July 28, 2010,May 2, 2011, one Canadian dollar was equal to approximately $0.97$1.05 in U.S. Currency.

GENERAL

The enclosed proxy is solicited by the boardBoard of directorsDirectors of Golden Queen Mining Co. Ltd., a British Columbia corporation (the “Company”"Company" or “Golden Queen”), for use at the SpecialAnnual General Meeting of Shareholders (the “Meeting”) of Golden Queen to be held at 10:00 a.m. (Pacific Standard Time) on Wednesday, September 1, 2010,Thursday, June 23, 2011, at the offices of Morton & Company, Suite 1200 - 750 West Pender Street, Vancouver, British Columbia, V6C 2T8, and at any adjournment or postponement thereof. References to “shares” in this document will mean common shares of the Company unless otherwise noted.

Our administrative offices are located at 6411 Imperial Avenue, West Vancouver, British Columbia, V7W 2J5. This Proxy Statement and the accompanying proxy card are being mailed to our shareholders on or about August 4, 2010.May 27, 2011.

The cost of solicitation will be bornepaid by the Company. The solicitation will be made primarily by mail. Proxies may also be solicited personally or by telephone by certain of the Company’s directors, officers and regular employees, who will not receive additional compensation therefore. In addition, the Company will reimburse brokerage firms, custodians, nominees and fiduciaries for their expenses in forwarding solicitation materials to beneficial shareholders.owners. The total cost of proxy solicitation, including legal fees and expenses incurred in connection with the preparation of this Proxy Statement and Information Circular, is estimated to be $12,000.

Our administrative offices are located at 6411 Imperial Avenue, West Vancouver, British Columbia, V7W 2J5.

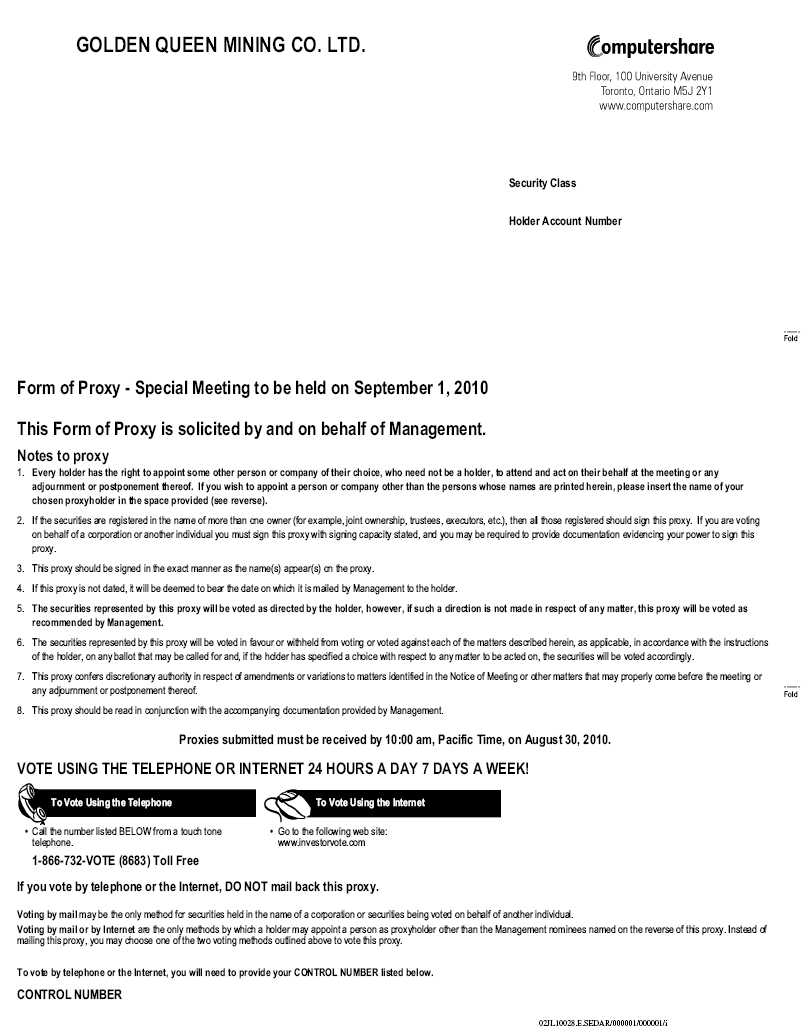

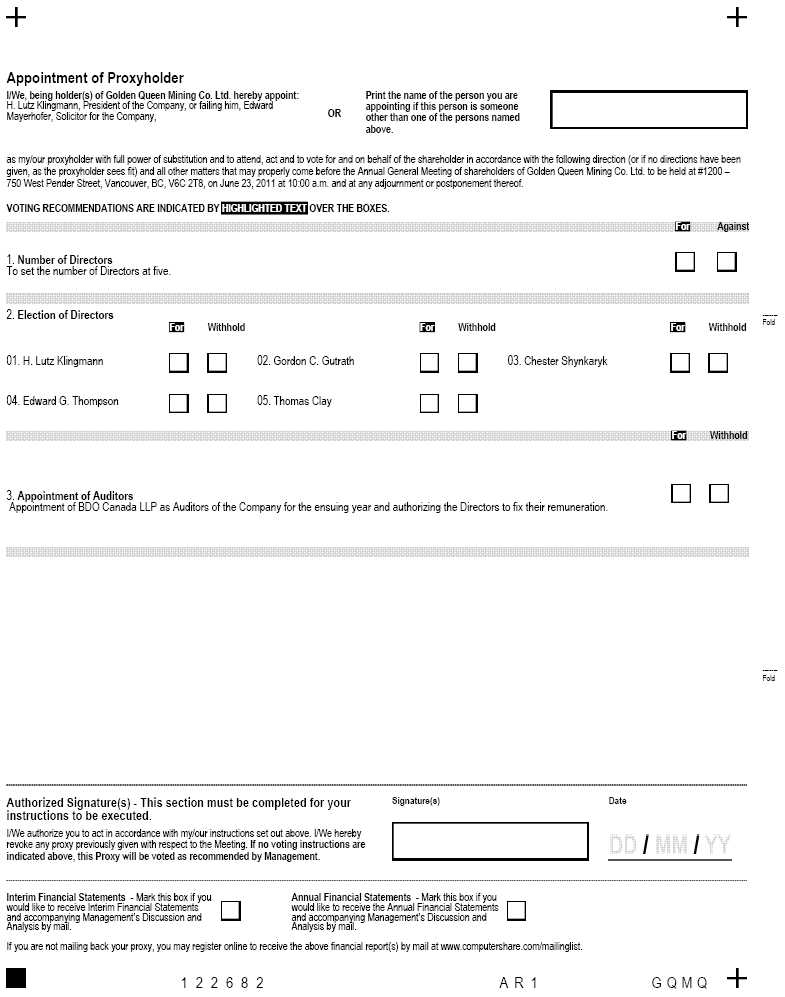

APPOINTMENT OF PROXYHOLDER

The persons named as proxyholder in the accompanying form of proxy were designated by the management of the Company (“Management Proxyholder”).A shareholder desiring to appoint some other person (“Alternate Proxyholder”) to represent him at the Meeting may do so by inserting such other person's name in the space indicated or by completing another proper form of proxy.A person appointed as proxyholder need not be a shareholder of the Company. All completed proxy forms must be deposited with Computershare Investor Services Inc. (“Computershare”) not less than forty-eight (48) hours, excluding Saturdays, Sundays, and holidays, before the time of the Meeting or any adjournment of it unless the chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently.

EXERCISE OF DISCRETION BY PROXYHOLDER

The proxyholder will vote for or against or withhold from voting the shares, as directed by a shareholder on the proxy, on any ballot that may be called for.In the absence of any such direction, the Management Proxyholder will vote in favour of matters described in the proxy. In the absence of any direction as to how to vote the shares, an Alternate Proxyholder has discretion to vote them as he or she chooses.

The enclosed form of proxy confers discretionary authority upon theproxyholder with respect to amendments or variations tomatters identified in the attached Notice of Meeting and other matters which may properlycome before the Meeting.At present, Management of the Company knows of no such amendments, variations or other matters.

14

PROXY VOTING

Registered Shareholders

If you are a registered shareholder, you may wish to vote by proxy whether or not you attend the Meeting in person. Registered shareholders electing to submit a proxy may do so by completing the enclosed form of proxy (the “Proxy”) and returning it to the Company’s transfer agent, Computershare, in accordance with the instructions on the Proxy. In all cases you should ensure that the Proxy is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

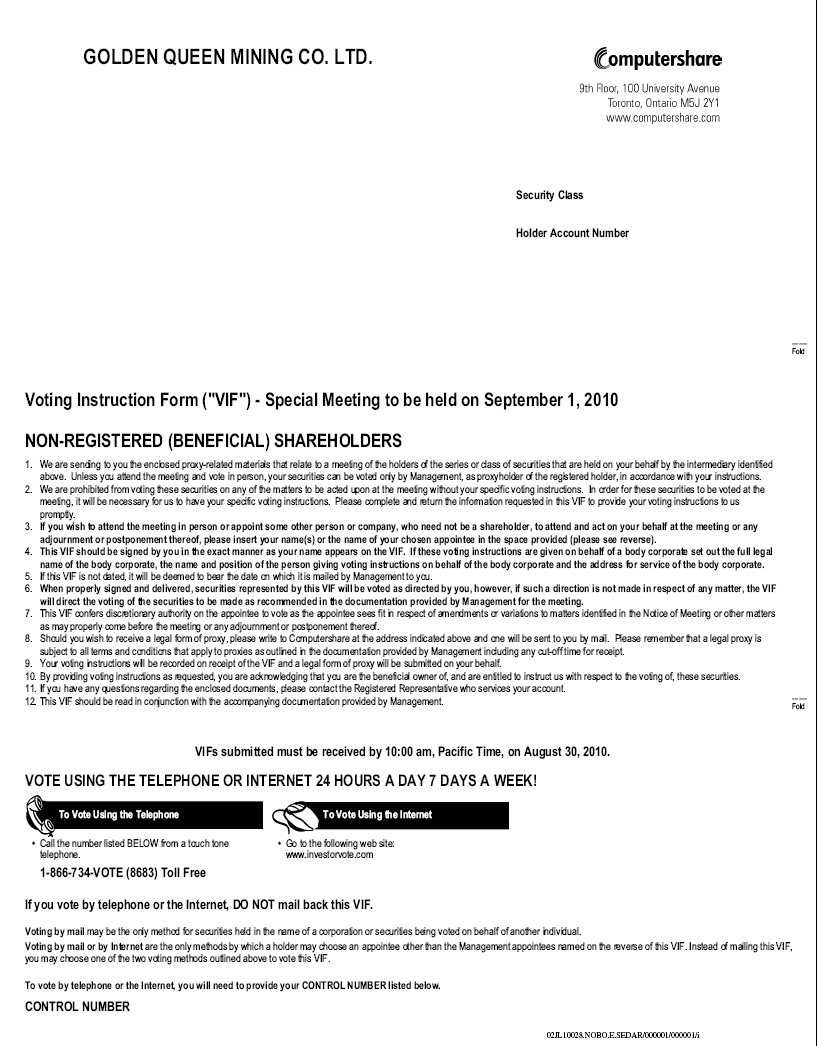

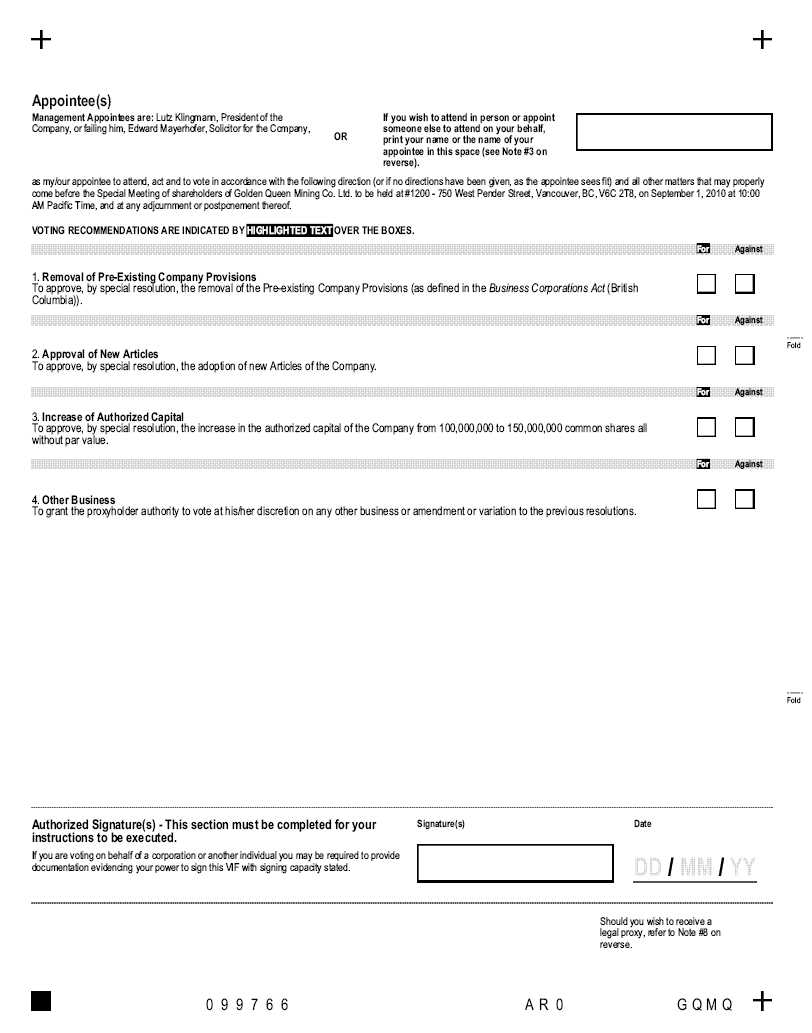

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold shares in their own name (referred to as “Beneficial Shareholders”). Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders (those whose names appear on the records of the Company as the registered holders of shares).

If shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those shares will not be registered in the shareholder's name on the records of the Company. Such shares will more likely be registered under the names of the shareholder's broker or an agent of that broker. In the United States, the vast majority of such shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

You should carefully follow the instructions of your broker or intermediary in order to ensure that your shares are voted at the Meeting. The form of proxy supplied to you by your broker will be similar to the Proxy provided to registered shareholders by the Company. However, its purpose is limited to instructing the intermediary on how to vote on your behalf. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge Investor Communication Services (“Broadridge”) in the United States and in Canada. Broadridge mails a voting instruction form in lieu of a Proxy provided by the Company. The voting instruction form will name the same persons as the Company's Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than the persons designated in the voting instruction form, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in the blank space provided in the voting instruction form. The completed voting instruction form must then be returned to Broadridge by mail or facsimile or given to Broadridge by phone or over the internet, in accordance with Broadridge's instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting.If you receive a voting instruction form from Broadridge, you cannot use it to vote shares directly at the Meeting - the voting instruction form must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have the shares voted.

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting shares registered in the name of your broker, you, or a person designated by you, may attend at the Meeting as proxyholder for your broker and vote your shares in that capacity. If you wish to attend the Meeting and indirectly vote your shares as proxyholder for your broker, or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the voting instruction form provided to you and return the same to your broker in accordance with the instructions provided by such broker, well in advance of the Meeting.

Alternatively, you can request in writing that your broker send you a legal proxy which would enable you, or a person designated by you, to attend at the Meeting and vote your shares.

25

REVOCATION OF PROXIES

In addition to revocation in any other manner permitted by law, a registered shareholder who has given a proxy may revoke it by:

| (a) | Executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the registered shareholder or the registered shareholder’s authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the proxy bearing a later date to Computershare | |

| (b) | Personally attending the meeting and voting the registered shareholders’ shares. |

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

Only registered shareholders have the right to revoke a Proxy. Non-Registered Holders who wish to change their vote must, at least seven days before the Meeting, arrange for their respective Intermediaries to revoke the Proxy on their behalf.

VOTING PROCEDURE

A quorum for the transaction of business at the Meeting is one person present at least two persons presentthe meeting representing in person being shareholders entitledor by proxy not less than 10% of the votes eligible to votecast at the Meeting or duly appointed proxies or representatives for absent shareholders so entitled.such meeting. Broker non-votes occur when a person holding shares through a bank or brokerage account does not provide instructions as to how his or her shares should be voted and the broker does not exercise discretion to vote those shares on a particular matter. Abstentions and broker nonvotes will be included in determining the presence of a quorum at the Meeting. However, an abstention or broker non-vote will not have any effect on the outcome for the election of directors.

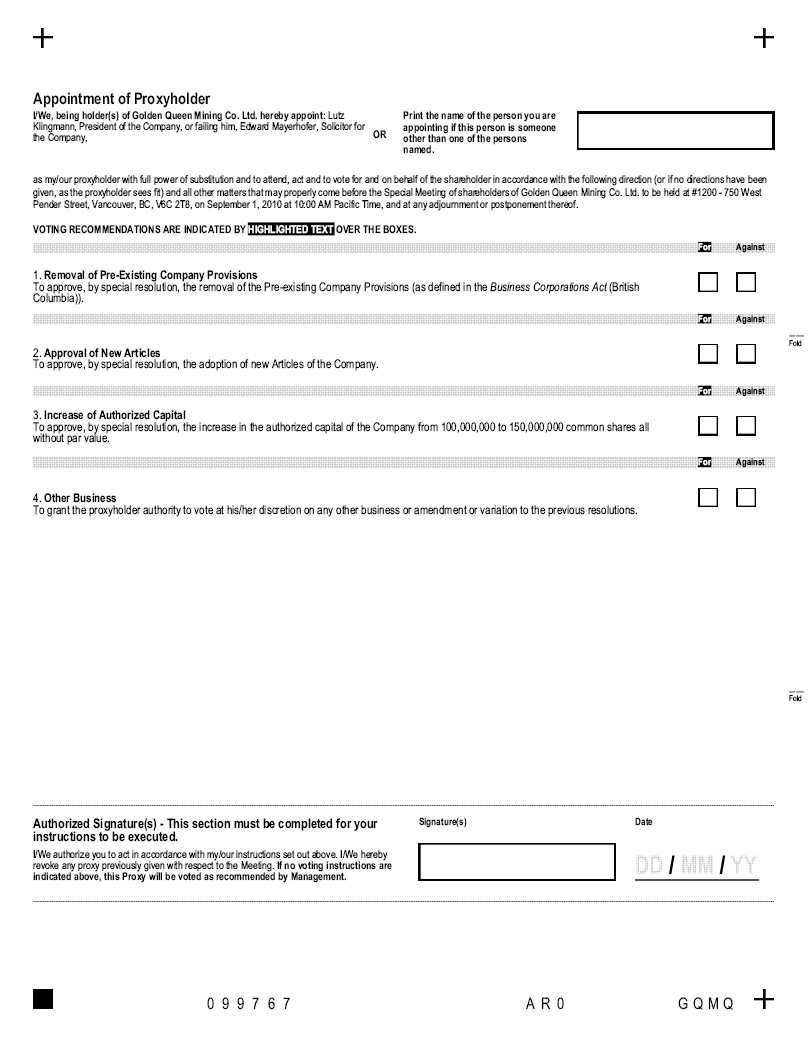

Shares for which proxy cards are properly executed and returned will be voted at the Meeting in accordance with the directions noted thereon or, in the absence of directions, will be voted "FOR" the fixing of the number of directors at five, “FOR” the approval, by special resolution,election of each of the removalnominees to the Board of Pre-existing Company Provisions (as defined indirectors named on theBusiness Corporations Act (British Columbia), “FOR” following page, and "FOR" the approval, by special resolution to ratify the appointment of the adoption of new ArticlesBDO Canada LLP as independent auditors of the Company and “FOR”for the approval, by special resolution, of the increase in the authorized capital of the Company from 100,000,000 to 150,000,000 common shares, all without par value.financial year ended December 31, 2011. It is not expected that any matters other than those referred to in this Proxy Statement will be brought before the Meeting. If, however, other matters are properly presented, the persons named as proxies will vote in accordance with their discretion with respect to such matters.

3

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On July 28, 2010May 2, 2011 (the “Record Date”) there were 94,078,38095,428,380 shares of our common stock (the “Common Stock”"Common Stock"), issued and outstanding, each share carrying the right to one vote. Only shareholders of record at the close of business on the Record Date will be entitled to vote in person or by proxy at the Meeting or any adjournment thereof.

6

To the knowledge of the Directorsdirectors and executive officers of the Company, the beneficial owners or persons exercising control over Company shares carrying more than 5% of the outstanding voting rights are:

| Name and Address | Number of Shares(1) | Nature of Ownership | Approximate % of Total Issued | Number of Shares(1) | Nature of Ownership | Approximate % of TotalIssued |

| Landon T. Clay Providence, RI | 726,077 | Sole voting and investment control | 0.77% | |||

| 21,956,063(2)(4) | Shared voting and investment control | 23.34% | ||||

| Thomas M. Clay Providence, RI | 1,168,522(3) | Sole voting and investment control | 1.24% | |||

| 17,158,969(2) | Shared voting and investment control | 18.24% | ||||

| Landon T. Clay Peterborough, NH | 3,555,045 | Sole voting and investment control | 3.73% | |||

| 19,127,095(2)(4) | Shared voting and investment control | 20.04% | ||||

| Thomas M. Clay Peterborough, NH | 1,168,522(3) | Sole voting and investment control | 1.22% | |||

| 14,330,001(2) | Shared voting and investment control | 15.02% | ||||

| Harris Clay Augusta, GA | 4,797,094(4) | Shared voting and investment control | 5.10% | 4,797,094(4) | Shared voting and investment control | 5.03% |

| Soledad Mountain LLC Delaware | 7,258,330(5) | Sole voting and investment control | 7.72% | 7,258,330(5) | Sole voting and investment control | 7.61% |

| Sprott Asset Management Inc. Toronto, ON | 11,860,300(6) | Sole voting and investment control | 12.61% | 11,860,300(6) | Sole voting and investment control | 12.43% |

| Gammon Gold Inc. Toronto, ON | 7,500,000(7) | Sole voting and investment control | 7.97% | 7,500,000(7) | Sole voting and investment control | 7.86% |

| (1) | The information relating to the above share ownership was obtained by the Company from insider reports and beneficial ownership reports filed with the SEC or available atwww.sedi.com, or from the shareholder, and includes direct and indirect holdings. | |

| (2) | Landon T. Clay and Thomas M. Clay have shared voting and investment control of | |

| (3) | Includes 300,000 shares issuable upon exercise of options. | |

| (4) | Landon T. Clay and Harris Clay have shared voting and investment control of 4,797,094 shares. | |

| (5) |

| |

| (6) | Sprott Asset Management LP holds the shares as portfolio manager. | |

| (7) | Includes 2,500,000 shares issuable upon exercise of share purchase warrants. |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as disclosed herein, no Person has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting other than the election of directors and the appointment of auditors and as set out herein. For the purpose of this paragraph, “Person” shall include each person: (a) who has been a director, senior officer or insider of the Company at any time since the commencement of the Company’s last fiscal year; (b) who is a proposed nominee for election as a director of the Company; or (c) who is an associate or affiliate of a person included in subparagraphs (a) or (b).

4PROPOSAL 1

ELECTION OF DIRECTORS

The Board of directors proposes to fix the number of directors at five and that the following five nominees be elected as directors at the Meeting, each of whom will hold office until the expiration of their term or until his or her successor shall have been duly appointed or elected and qualified: H. Lutz Klingmann, Edward G. Thompson, Gordon C. Gutrath, Chester Shynkaryk, and Thomas M. Clay.

Unless otherwise instructed, it is the intention of the persons named as proxies on the accompanying proxy card to vote shares represented by properly executed proxies for the election of such nominees. Although the Board of directors anticipates that the five nominees will be available to serve as directors of Golden Queen, if any of them should be unwilling or unable to serve, it is intended that the proxies will be voted for the election of such substitute nominee or nominees as may be designated by the Board of directors.

7

PROPOSAL 1THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" FIXING THE NUMBER OF DIRECTORS AT FIVE AND “FOR” THE ELECTION OF EACH NOMINEE.

REMOVAL OF PRE-EXISTING COMPANY PROVISIONS

Effective March 29, 2004, theBusiness Corporations Act (British Columbia) (the “Corporations Act”) replacedThe following table sets out the previousnames of the nominees; their positions and offices in the Company; principal occupations; the period of time that they have been directors of the Company; and the number of shares of the Company Act (British Columbia) (the “which each beneficially owns or over which control or direction is exercised.

| Name, Residence and PresentPosition with the Company | Director Since | # SharesBeneficiallyOwned, Directlyor Indirectly, orOver WhichControl orDirection isExercised[1] | Principal Occupation, Qualifications, and OtherDirectorships During Past Five Years[2] |

| H. LUTZ KLINGMANN Director, President West Vancouver, BC | March 1, 2001 | 415,400 | Mr. Klingmann was appointed president of the Company on November 29, 2002. He also acts as a director of Minto Explorations Ltd. since 1993. Mr. Klingmann is a registered professional engineer in British Columbia. |

| CHESTER SHYNKARYK[3] Director Delta, BC | November 21, 1985 | 130,000 | Mr. Shynkaryk served as the president of the Company from 1985 to 1995, and as Secretary from 1996 to 2004. In addition, he serves as a director of Global Uranium Corp. |

| GORDON C. GUTRATH[3] Director Vancouver, BC | August 14, 1987 | 265,000 | Mr. Gutrath’s principal occupation is president of Atled Exploration Management Ltd. Mr. Gutrath is a professional geologist and a registered professional engineer in British Columbia. |

| EDWARD G. THOMPSON[3] Director Toronto, ON | November 25, 1994 | 452,500 | Mr. Thompson’s principal occupation is president of E.G. Thompson Mining Consultants, Inc. He is also a director and chairman of Sparton Resources Inc. He serves on the Board of directors of Copper Reef Mining Corp., Rae Wallace Mining Company, Stratabound Minerals Corp., Tri Origin Exploration Ltd., and Western Troy Capital Resource, Inc. Mr. Thompson graduated from the University of Toronto in 1959 with a degree in mining geology and in 1960 he earned a degree in economic geology. He has been a member of the Professional Engineers of Ontario since 1961. |

| THOMAS M. CLAY Director Peterborough, NH | January 13, 2009 | 15,498,523[4] | Mr. Clay’s principal occupation is vice-president of East Hill Management Company, LLC. He also serves as a director of The Clay Mathematics Institute of Cambridge, MA. Mr. Clay holds an A.B. degree from Harvard University in Classics and a M.St. degree from Oxford University in Greek and Latin Languages and Literatures. |

| [1] | Based upon information furnished to Golden Queen by either the directors and executive officers or from the insider reports available atwww.sedi.com |

| [2] | The information as to principal occupation and business or employment is not within the knowledge of the management of the Company and has been furnished by the respective nominees. |

| [3] | Member of Audit Committee. |

| [4] | Landon T. Clay and Thomas M. Clay have shared voting and investment control of 14,330,001 shares. |

8

Old ActH. Lutz Klingmann”). Ashas been the President of the Company since 2002. Mr. Klingmann is primarily responsible for the recent permitting approvals of the Soledad Mountain Project by the Kern County Planning Commission and other state agencies. The Board believes that Mr. Klingmann’s expertise and experience as a consequence, all British Columbia companies are now governed under the Corporations Act. Every British Columbia company must have transitionedprofessional engineer, in mine development, and specifically in regards to the CorporationsSoledad Mountain Project, is valuable to the Board.

Chester Shynkarykwas the former President of the Company for ten years, and as such, has extensive knowledge of the Company’s business and operations. The Board believes that Mr. Shynkaryk’s knowledge of the Soledad Mountain Project and its history is valuable to the Board.

Gordon C. Gutrathhas been on the Board since 1987 and has extensive knowledge of the Company’s business and operations. Mr. Gutrath’s experience as a professional geologist and his independence from management make him a valuable member of the Board.

Edward G. Thompsonhas been on the Board since 1994 and has extensive knowledge of the Company’s business and operations. Mr. Thompson’s experience and his independence from management make him a valuable member of the Board.

Thomas M. Clayrepresents the interests of certain significant shareholders of the Company, and as such, the Board believes that Mr. Clay is valuable as a member of the Board.

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of May 2, 2011 by:

| (i) | each director of Golden Queen; |

| (ii) | each of the Named Executive Officers of Golden Queen; and |

| (iii) | all directors and executive officers as a group. |

Except as noted below, Golden Queen believes that the beneficial owners of the Common Stock listed below, based on information furnished by such owners, have sole voting and investment power with respect to such shares.

| Name and Address ofBeneficial Owner | SharesBeneficially Owned | Percentage of SharesBeneficially Owned[1] |

| H. LUTZ KLINGMANN, Director, President West Vancouver, BC | 915,400[1] | 0.94% |

| CHESTER SHYNKARYK, Director Delta, BC | 630,000[1] | 0.65% |

| GORDON C. GUTRATH, Director Vancouver, BC | 465,000[1] | 0.48% |

| EDWARD G. THOMPSON, Director Toronto, ON | 802,500[1] | 0.82% |

| THOMAS M. CLAY, Director Peterborough, NH | 15,798,523[1][2] | 16.24% |

| All officers and directors (5) persons | 18,611,423[1] | 19.13% |

| [1] | These amounts include beneficial ownership of securities not currently outstanding but which are reserved for immediate issuance on exercise of options. In particular, these amounts include shares issuable upon exercise of options as follows: 350,000 shares issuable to Edward Thompson; 400,000 shares issuable to Chester Shynkaryk; 200,000 shares issuable to Gordon Gutrath, 500,000 shares issuable to Lutz Klingmann, and 300,000 shares issuable to Thomas M. Clay. |

| [2] | Landon T. Clay and Thomas M. Clay have shared voting and investment control of 14,330,001 of these shares. |

9

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act within twoof 1934, as amended, requires Golden Queen's directors, executive officers and persons who own more than 10% of a registered class of Golden Queen’s securities to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of Golden Queen. Directors, executive officers and greater than 10% shareholders are required by SEC regulation to furnish Golden Queen with copies of all Section 16(a) reports they file.

To Golden Queen’s knowledge, based solely on a review of Forms 3 and 4, as amended, furnished to it during its most recent fiscal year, and Form 5, as amended, furnished to it with respect to such year, Golden Queen believes that during the year ended December 31, 2010, its directors, executive officers and greater than 10% shareholders complied with all Section 16(a) filing requirements of the Securities Exchange Act of 1934.

DIRECTORS AND EXECUTIVE OFFICERS

The following table contains information regarding the members and nominees of the Board of Directors and the Executive of Golden Queen as of the Record Date:

| Name | Age | Position | Position Held Since |

| Edward G. Thompson | 74 | Director | November 25, 1994 |

| H. Lutz Klingmann | 71 | Director President | March 1, 2001 November 29, 2002 |

| Chester Shynkaryk | 66 | Director | November 21, 1985 |

| Gordon C. Gutrath | 73 | Director | August 14, 1987 |

| Thomas M. Clay | 26 | Director | January 13, 2009 |

All of the officers identified above serve at the discretion of the Board of Directors and have consented to act as directors of the Company.

RELATIONSHIPS AMONG DIRECTORS OR EXECUTIVE OFFICERS

There are no family relationships among any of the existing directors or executive officers of Golden Queen.

BOARD OF DIRECTORS MEETINGS AND COMMITTEES

During the fiscal year ended December 31, 2010, the Board of Directors held 3 directors’ meetings. All other matters which required Board approval were consented to in writing by all of the Company’s directors.

The Board of Directors has established an Audit Committee and a Compensation Committee. The Board of Directors has no standing nominating committee. Each of the Audit and Compensation Committees is responsible to the full Board of Directors. The functions performed by these committees are summarized below:

Audit Committee. The Audit Committee considers the selection and retention of independent auditors and reviews the scope and results of the audit. In addition, it reviews the adequacy of internal accounting, financial and operating controls and reviews Golden Queen’s financial reporting compliance procedures. The members of the Audit Committee are Chester Shynkaryk, Edward G. Thompson and Gordon C. Gutrath. Chester Shynkaryk is the Chair of the Audit Committee.

In the course of its oversight of our financial reporting process, the directors have: (1) reviewed and discussed with management our audited financial statements for the year ended December 31, 2010; (2) received a report from BDO Canada LLP our independent auditors, on the matters required to be discussed by Statement on Auditing Standards No. 61, “Communications with Audit Committees”; (3) received the written disclosures and the letter from the auditors required by Public Company Accounting Oversight Board Rule 3526; and (4) considered whether or note the provision of non-audit services by the auditors is compatible with maintaining their independence and has concluded that it is compatible at this time.

Based on the foregoing review and discussions, the Board has concluded that the audited financial statements should be included in our Annual Report on Form 10-K for the year ended December 31, 2010 filed with the SEC.

10

Compensation Committee. The Compensation Committee reviews and approves the compensation of Golden Queen’s officers, reviews and administers Golden Queen’s stock option plan and makes recommendations to the Board of Directors regarding such matters. The members of the Compensation Committee are Gordon C. Gutrath, Edward G. Thompson and Chester Shynkaryk.

Nominating Committee. No Nominating Committee has been appointed. Nominations of directors are made by the Board of Directors. The Board is of the view that the present management structure does not warrant the appointment of a Nominating Committee.

DIRECTORS COMPENSATION

Directors’ fees were paid to each director in the amount of C$2,000, or $2,000 as appropriate, for the year ended December 31, 2010 and per year thereafter. The fees in respect of each year are due on December 1 of that year.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth all information concerning the total compensation of Golden Queen’s president, chief executive officer, chief financial officer, and the three other most highly compensated officers during the last fiscal year (the “Named Executive Officers”) during the last three completed fiscal years for services rendered to Golden Queen in all capacities.

| Name andPrincipalPosition | Year | Salary ($) | Bonus ($) | StockAwards ($) | OptionAwards ($) | Non-EquityIncentive PlanCompensation ($) | NonqualifiedDeferredCompensationEarnings ($) | All OtherCompensation ($) | Total ($) |

| Lutz Klingmann President | 2010 | $141,293 | Nil | Nil | Nil | Nil | Nil | 1,974 | $143,267 |

| 2009 | $116,776 | Nil | Nil | $91,792[1] | Nil | Nil | Nil | $208,568 | |

| 2008 | $136,500 | Nil | Nil | Nil | Nil | Nil | Nil | $136,500 |

[1] The determination of the value of option awards is based upon the Black-Scholes Option pricing model, details and assumptions of which are set out in Note 6 to the Company’s consolidated financial statements for the fiscal year ended December 31, 2010.

OPTION/SAR GRANTS DURING THE MOST RECENTLY COMPLETED FINANCIAL YEAR

The Board of Directors approves the issuance of stock options to our directors, officers, employees and consultants. Unless otherwise provided by the Board of Directors, all vested options are exercisable for a term of five years from the comingdate of grant. During the fiscal year ended December 31, 2010, Golden Queen granted 50,000 stock options exercisable at a price of C$1.24 for a period of 5 years from the date of grant to a consultant.

11

OUTSTANDING EQUITY AWARDS AT THE MOST RECENTLY COMPLETED FINANCIAL YEAR

| Name andPrincipalPosition | Number ofSecuritiesUnderlyingUnexercisedOptions (#) Exercisable | Number ofSecuritiesUnderlyingUnexercisedOptions (#) Unexercisable | EquityIncentive PlanAwards;Number ofSecuritiesUnderlyingUnexercisedUnearnedOptions (#) | Option ExercisePrice ($) | Option Expiration Date |

| Lutz Klingmann President | 350,000 500,000 | Nil Nil | Nil Nil | $0.77 $0.26 | April 20, 2011 January 28, 2014 |

| Chester Shynkaryk Director | 300,000 400,000 | Nil Nil | Nil Nil | $0.77 $0.26 | April 20, 2011 January 28, 2014 |

| Gordon Gutrath Director | 250,000 200,000 | Nil Nil | Nil Nil | $0.77 $0.26 | April 20, 2011 January 28, 2014 |

| Edward Thompson Director | 300,000 350,000 | Nil Nil | Nil Nil | $0.77 $0.26 | April 20, 2011 January 28, 2014 |

| Thomas M. Clay Director | 300,000 | Nil | Nil | $0.26 | January 28, 2014 |

12

AGGREGATED STOCK OPTION/SAR EXERCISES DURING THE MOST RECENTLY COMPLETED FINANCIAL YEAR AND FINANCIAL YEAR-END OPTION/SAR VALUES

700,000 stock options at a price of C$0.35 per share and 150,000 stock options at a price of C$0.26 per share were exercised during the Company’s fiscal year ended December 31, 2010.

TERMINATION OF EMPLOYMENT, CHANGE IN RESPONSIBILITIES AND EMPLOYMENT CONTRACTS

There are currently no employment contracts in place with the directors and officers of Golden Queen other than the following: On March 11, 2004, we entered into forcea management agreement with Lutz Klingmann. Pursuant to the terms of the Corporations Act.agreement, Mr. Klingmann acts as chief operating officer and has overall management responsibility for our operations. Mr. Klingmann receives C$60 per hour as compensation for his work and also receives C$5 per hour for use of his office, equipment and out-of-pocket expenses. The management agreement also provides for the issuance of up to 300,000 Common Shares of Golden Queen to Mr. Klingmann on attaining certain milestones.

COMPENSATION COMMITTEE

Composition of the Compensation Committee

The members of the Compensation Committee during the year ended December 31, 2010 were Edward G. Thompson, Chester Shynkaryk and Gordon Gutrath. Mr. Shynkaryk was president of the Company transitioneduntil December 1, 1995 and served as Secretary until 2004. Mr. Thompson served as president until November 29, 2002.

Report on Executive Compensation

The Compensation Committee of the Board of Directors is responsible for reviewing and approving the remuneration of the senior management of the Company, including the President and chief executive officer. The guiding philosophy of the Compensation Committee in the determination of executive compensation is ensuring that the Company is able to attract the best possible candidates for management positions, given the high level of competition for competent management in the mining industry, and to align the interests of management with those of the Company’s shareholders.

The Company’s executive compensation policies are designed to recognize and reward individual contribution, performance and level of responsibility and ensure that the compensation levels remain competitive with other precious metals development and mining companies. The key components of total compensation are base salary and incentives.

The Compensation Committee has no formal process for determining appropriate base salary ranges. Currently the Company pays executive compensation in the form of a base salary to its President only. The base salary to the Corporations Act in 2005.

UnderPresident was based on a proposal from the Corporations Act certain Pre-ExistingPresident, which was accepted by the Company Provisions (the “PCPs”) continue to applyafter considering his experience and expected responsibility and contribution to the Company unless such provisionsCompany.

Stock options are removed by waygranted to senior management to align the financial interests of special resolutionmanagement with the interests of shareholders of the shareholders. RemovalCompany and to encourage senior management to focus on strategies and results that enhance shareholder value in the longer term. The number of options to purchase Common Shares granted to each individual will depend largely on his level of responsibility and contribution to the Company’s performance.

The Compensation Committee considers, on an ongoing basis, the appropriateness and effectiveness of the PCPs would permitCompany’s executive compensation policies, given prevailing circumstances.

Submitted by the Compensation Committee.

EDWARD G. THOMPSON (Chairman), GORDON GUTRATH, AND CHESTER SHYNKARYK.

13

PERFORMANCE GRAPH

The following graph tracks the percentage change in the Company’s share price compared to the percentage change in the CBOE Gold Index.

| December 31, 2006 | December 31, 2007 | December 31, 2008 | December 31, 2009 | December 31, 2010 | |

| Company | 100 | 90 | 42 | 103 | 301 |

| S&P/TSX Global Gold Index (TITTGD) | 100 | 95 | 96 | 103 | 129 |

14

COMPENSATION OF DIRECTORS

It is currently the policy of the Company to adopt updated corporate articles that reflect current business practicegrant options to purchase Common Shares to its directors under the Corporations Act.

Company’s 2008 Stock Option Plan (the “Plan”). The boardfollowing is a summary of the material terms of the Plan in accordance with the rules and policies of the Toronto Stock Exchange (the “Exchange”):

| i) | the eligible participants under the Plan are directors, officers, employees and consultants of the Company; | ||

| ii) | the number of common shares reserved for issuance from time to time under the Plan is 7,200,000, which represents 7.5% of the number of issued and outstanding shares of the Company; | ||

| iii) | if any stock option is exercised or expires or otherwise terminates for any reason, the number of common shares in respect of which the stock option is exercised or expired or terminated shall again be available for the purposes of the Plan; | ||

| iv) | options granted and outstanding under our previous 1996 Stock Option Plan will be governed by the Plan. There are currently no stock options granted and outstanding pursuant to the Company’s previous stock option plan; | ||

| v) | the aggregate number of options awarded within any one-year period to insiders under the Plan or any previously established and outstanding stock option plans or grants, cannot exceed 10% of the issued Shares of the Company (calculated at the time of award); or the aggregate number of Shares reserved at any time for issuance to insiders upon the exercise of Options awarded under the Plan or any previously established and outstanding stock option plans or grants, cannot exceed 10% of the issued Shares of the Company (calculated at the time of award); | ||

| vi) | the maximum number of securities one person or company is entitled to receive is subject to the Exchange policies, and is otherwise not restricted; | ||

| vii) | the exercise price for securities under the Plan will be determined by the Board of Directors in its sole discretion as of the date of grant, and shall not be less than: | ||

| (a) | if the Company’s shares are not listed for trading on an Exchange at the date of grant, the last price at which the Company’s shares were issued prior to the date of grant; or | ||

| (b) | if the Company’s shares are listed for trading on an Exchange at the date of grant, the closing price of the Company’s shares on the day immediately preceding the date of grant; | ||

| viii) | The purchase price for securities under the Plan cannot be below the VWAP for the five trading days immediately prior to the date of award; | ||

| ix) | the value of a share for stock appreciation rights shall be determined, unless otherwise specified or permitted by applicable regulatory policies, based on the weighted average trading price per share for the five trading days immediately preceding the date the notice is received by the Company on the Exchange; | ||

| x) | a stock appreciation right granted pursuant to the Plan shall entitle the option holder to elect to surrender to the Company, unexercised, the option with which it is included, or any portion thereof, and to receive from the Company in exchange therefor that number of shares, disregarding fractions, having an aggregate value equal to the excess of the value of one share over the purchase price per share specified in such option, times the number of shares called for by the option, or portion thereof, which is so surrendered; | ||

| xi) | the Board of Directors may grant stock options to any director, officer or employee, together with a bonus consisting of a corresponding right to be paid, in cash, an amount equal to the exercise price of such stock options, subject to such provisos and restrictions as the Board may determine, and subject to any applicable approvals, if required; | ||

15

| xii) | all options granted pursuant to the Plan will be subject to such vesting requirements as may be prescribed by the Exchange, if applicable, or as may be imposed by the Board of Directors; | ||

| xiii) | the expiry date of an option shall be the date so fixed by the Board of Directors at the time the particular option is awarded, provided that such date shall not be later than the fifth anniversary of the date of grant of the option; | ||

| xiv) | any options granted pursuant to the Plan will terminate generally within 90 days of the option holder ceasing to act as a director, officer, or employee of the Company or any of its affiliates, and within generally 30 days of the option holder ceasing to act as an employee engaged in investor relations activities, unless such cessation is on account of death. If such cessation is on account of death, the options terminate on the first anniversary of such cessation. If such cessation is on account of cause, or terminated by regulatory sanction or by reason of judicial order, the options terminate immediately. Options that have been cancelled or that have expired without having been exercised shall continue to be issuable under the Plan. The Plan also provides for adjustments to outstanding options in the event of any consolidation, subdivision, conversion or exchange of Company’s shares; | ||

| xv) | options may not be assigned or transferred; | ||

| xvi) | the Board may amend the Plan and the terms and conditions of any Option thereafter to be granted without shareholder approval, unless shareholder approval is expressly required under any relevant law, rule or regulation, or the policies of the Exchange; | ||

| xvii) | any substantive amendments to the Plan shall be subject to the Company first obtaining the approvals, if required, of: | ||

| (a) | the shareholders or disinterested shareholders, as the case may be, of the Company at general meetings where required by the rules and policies of the Exchange, or any stock exchange on which the Shares may then be listed for trading; and | ||

| (b) | the Exchange, or any stock exchange on which the Shares may then be listed for trading; | ||

| xviii) | there are no provisions in the Plan for direct financial assistance to be provided by the Company to participants under the Plan to facilitate the purchase of securities under the Plan, although the Plan does permit stock appreciation rights and bonuses to be issued together with Options as described above; | ||

| xix) | pursuant to the policies of the Exchange, the Plan must be approved by shareholders every three years; and | ||

| xx) | there are no entitlements under the Plan previously granted and subject to ratification by security holders. | ||

There are no other arrangements under which directors of the Company proposeswere compensated by the Company during the year ended December 31, 2010 for their services in their capacity as directors and, without limiting the generality of the foregoing, no additional amounts are payable under any standard arrangements for committee participation or special assignments, except that the Articles of the Company provide that the directors are entitled to removebe paid reasonable traveling, hotel and other expenses incurred by them in the PCPs. Ifperformance of their duties as directors. The Company’s Articles also provide that if a director is called upon to perform any professional or other services for the Company that, in the opinion of the directors, is outside of the ordinary duties of a director, such director may be paid a remuneration to be fixed by the directors and such remuneration may be either in addition to or in substitution for any other remuneration that such director may be entitled to receive.

16

The aggregate direct remuneration paid or payable by the Company and its subsidiary (the financial statements of which are consolidated with those of the Company) to the directors and senior officers of the Company during the financial year ended December 31, 2010 was $143,267, $141,293 of which was paid to Lutz Klingmann for his services as president of the Company and $1,974 of which was paid to Lutz Klingmann as director’s fees, $17,769 was paid to Chester Shynkaryk as a consulting fee, $1,974 of which was paid to Chester Shynkaryk as director’s fees, $1,974 of which was paid to Gordon Gutrath as director’s fees, $1,974 of which was paid to Edward Thompson as director’s fees and $2,000 of which was paid to Thomas M. Clay as director’s fees. No other compensation was paid or given during the year for services rendered by the directors in such capacity, and no additional amounts were payable at year-end under any standard arrangements for committee participation or special assignments.

REPORT OF CORPORATE GOVERNANCE

The Canadian Securities Administrators have adopted National Instrument 58-101Disclosure of Corporate Governance Practices(“NI 58-101”) and National Policy 58-201Corporate Governance Guidelines(“NP 58-201”) (the “Guidelines”), both of which came into force as of June 30, 2005 and effectively replaced the corporate governance guidelines and disclosure policies of the Toronto Stock Exchange. NI 58-101 requires issuers such as the Company to disclose the corporate governance practices that they have adopted, while NP 58-201 provides guidance on corporate governance practices. In this regard, a brief description of the Company’s system of corporate governance, with reference to the items set out in NI 58-101 and NP 58-101 is set forth below.

The Board of Directors and management recognize that effective corporate governance is important to the direction and operation of the Company in a manner which ultimately enhances shareholder value. As a result, the Company has developed and implemented, and continues to develop, implement and refine formal policies and procedures which reflect its ongoing commitment to good corporate governance. The Company believes that the corporate governance practices and procedures described below are appropriate for a company such as the Company.

Board of Directors

The Board is responsible for overseeing management of the Company and determining the Company’s strategy and for determining whether or not a director is independent. In making this determination, the Board has adopted the definition of “independence” as set forth in NI 58-101 and NP 58-201, which recommends that a majority of the Board of Directors be considered “independent”. In applying this definition, the Board considers all relationships of the directors of the Company, including business, family and other relationships. As at the date of this Management Information Circular, there are five (5) directors on the Board, Lutz Klingmann, Chester Shynkaryk, Gordon Gutrath, Edward Thompson, and Thomas M. Clay. Of the five directors, Chester Shynkaryk, Gordon Gutrath, and Edward Thompson are considered independent. Lutz Klingmann, President of the Company, and Thomas Clay, are not considered independent. Subject to the approval of the proposed slate for election on June 23, 2011, there will be five (5) directors on the Board, three (3) of whom will be considered independent and two (2) of whom will be considered non-independent.

Other Directorships

The following table sets forth the current directors of the Company who are directors of other reporting issuers:

| Lutz Klingmann | None |

| Chester Shynkaryk | Global Uranium Corp. |

| Gordon Gutrath | None |

| Edward Thompson | Sparton Resources Inc. |

| Copper Reef Mining Corp. | |

| Stratabound Minerals Corp. | |

| Tri Origin Exploration Ltd. | |

| Western Troy Capital Resources Inc. | |

| Thomas M. Clay | None |

17

Director Meetings

The Audit Committee, comprised entirely of independent directors, meets 4 times a year. Chester Shynkaryk acts as chairman of such meetings.

During the financial year ended December 31, 2010, the Board held 3 meetings, of which each director was in attendance.

Board Mandate

The Board of Directors of the Company is responsible for supervising management in carrying on the business and affairs of the Company. Directors are required to exercise their powers with reasonable prudence in the best interests of the Company. The Board has expressly confirmed its commitment to the principles set out in the Guidelines and has accepted and confirmed its responsibility for overseeing management’s performance in the following particular areas:

| (a) | the strategic planning process of the Company; |

| (b) | identification and management of the principal risks associated with the business of the Company; |

| (c) | planning for succession of management; |

| (d) | the Company’s policies regarding communications with its shareholders and others; |

| (e) | the establishment by the Company of, and compliance with, appropriate environmental policies; and |

| (f) | the integrity of the internal controls and management information system of the Company. |

In carrying out its mandate, the Board relies primarily on management to provide it with regular detailed reports on the operations of the Company and its financial position. The Board reviews and assesses these reports and other information provided to it at meetings of the full Board and its committees. The Company’s former president and chief executive officer, Edward G. Thompson, was a member of the Board, and the Company’s present president, Lutz Klingmann, is a member of the Board, giving the Board direct access to information on his areas of responsibility

The reports and information provided to the Board on a regular basis discuss the Company’s operations with respect to the exploration and development of the Soledad Mountain Project and include such matters as the permitting process, property acquisitions, staff additions and changes, financing and investor relations activities, expenditures and results of operations and the procedures followed to monitor and manage the risks associated with the Company’s operations. At least semi-annually, management reports to the Board on its strategic and business plan, performance relative to that plan and any changes in the plan. From time to time, members of the Board may be involved with management in developing recommendations to the full Board on particular issues such as acquisitions or financings. Certain areas of the Board’s responsibility are delegated to regular or special committees of the Board which report back to the full Board on their considerations.

The Guidelines recommend that a Board of Directors should implement a system which enables an individual director to engage an outside adviser at company expense in certain circumstances. While the Board has not formalized any such system, the members of the Board are aware that they have the right to retain outside advisers, at the Company’s expense, when appropriate. The Guidelines recommend that a Board of Directors should examine its size with a view to its effectiveness. The Board is satisfied that its current size is appropriate to effectively perform its duties.

The Guidelines recommend that a Board of Directors should expressly assume responsibility for developing the corporation’s approach to governance issues. The Board as a whole takes responsibility for developing the Company’s approach to corporate governance issues, including, among other things, the Company’s response to the Guidelines.

Orientation and Continuing Education

Management provides new directors with an overview of their role as a member of the Board and its Committees, and the nature and operation of the Company’s business and affairs. New directors also have the opportunity to discuss the Company’s affairs with legal counsel and the representative of the Company’s external auditors. New directors are also provided with opportunities to visit the mine sites and are invited to have discussions with the Company’s operating personnel.

18

The directors are focused primarily on Project development and corporate/securities regulatory compliance. Four of the five directors on the Board have significant mining or advanced resource property development experience with public companies. The remaining director is a nominee of a controlling shareholder group. All directors are in regular contact with the President of the Company regarding the status of the Project and Company matters. The Board considers the foregoing factors as being sufficient to establish that the Board has the appropriate and current skill and knowledge necessary to meet their obligations as directors of the Company.

Ethical Business Conduct

The Board has adopted a Code of Ethics For Senior Financial Officers (the “Code”) as a guideline for the oversight of the ethical conduct of management. The Company’s audit committee monitors compliance with the Code, and the Board and audit committee are responsible for granting any waivers from the Code. During the recently completed financial year, there was no conduct by a director or executive officer that constituted a departure from the Code and no material change report in that respect has been filed. The Company Code of Conduct is available on the Company’s website.

Nomination of Directors

The Company does not have a nominating committee. Although the Company does not have a nominating committee, the Board is satisfied that in view of size and composition of the Board, it is more efficient and cost effective for the full Board to perform the duties of the nominating committee as set out in the Guidelines. The Board recruits new directors as needed from time to time. Any appointment of a new director requires Board approval and is subject, ultimately, to approval by the shareholders of the Company approveat the proposal to removenext annual general meeting of shareholders of the PCPs,Company.

Compensation

The Company has a compensation committee (the “Compensation Committee”) that consists of Gordon Gutrath, Edward Thompson and Chester Shynkaryk. As a result, the Compensation Committee is composed entirely of “independent” directors. The Compensation Committee does not currently have a written charter, but is in the process of developing one. The Compensation Committee has been established to:

Other Board Committees

The Company does not have any standing committees other than the audit committee and the compensation committee.

Assessments

Other than as contemplated in the form attached hereto as Appendix “A”, withCode, the British Columbia Registrar of Companies implementingBoard does not have formal policies or processes in place to review and assess the removalperformance of the PCPs.directors. The Board is of a small size, and all members, save one, have a long history of Board membership. For this reason, the Board has not implemented formal procedures and processes to assess performance of directors and committees.

In the Board’s opinion, the current corporate governance practices of the Company are adequate and appropriate for a company at its stage of development and are consistent with both the spirit and intent of the Guidelines. The Board will continue to review, and change where necessary, its approach to corporate governance.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with management and others

The removalfollowing is in addition to disclosure contained elsewhere herein respecting transactions involving management.

19

On March 11, 2004, we entered into a management agreement with Lutz Klingmann. Pursuant to the terms of the PCPs requiresagreement, Mr. Klingmann acts as chief operating officer and has overall management responsibility for our operations. Mr. Klingmann receives C$60 per hour as compensation for his work and also receives C$5 per hour for use of his office, equipment and out-of-pocket expenses. The management agreement also provides for the affirmativeissuance of up to 300,000 Common Shares of the Golden Queen to Mr. Klingmann on the attaining of certain milestones.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

BDO Canada LLP served as Golden Queen’s independent auditors for the fiscal year ended December 31, 2010, and has been appointed by the Board of Directors to continue as Golden Queen’s independent auditor for Golden Queen’s fiscal year ending December 31, 2011, and until the next annual general meeting of shareholders.

The fees for services provided by BDO Canada LLP to us in each of the fiscal years ended 2009 and 2010 were as follows:

| Fees | 2009 | 2010 |

| Audit fees | $49,500 | $57,500 |

| Audit related fees | $6,500 | $77,000 |

| Tax fees | $12,850 | $2,050 |

| All other fees | Nil | $Nil |

20

Although the appointment of BDO Canada LLP is not required to be submitted to a vote of not less than 75%the shareholders, the Board of Directors believes it appropriate as a matter of policy to request that the shareholders ratify the appointment of the independent auditors for the fiscal year ending December 31, 2011. In the event a majority of the votes cast at the Meeting by shareholdersmeeting are not voted in favor of ratification, the Company, present in person or by proxy. Accordingly, the Company’s shareholdersadverse vote will be asked to consider and, if thought advisable, to pass, with or without amendment, a special resolution as follows:

“BE IT RESOLVED,considered as a Special Resolution, THAT:direction to the Board of Directors of Golden Queen to select other auditors for the fiscal year ending December 31, 2011.

| |

| |

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE REMOVALRATIFICATION OF THE PRE-EXISTING COMPANY PROVISIONS.

5

PROPOSAL 2

ADOPTIONAPPOINTMENT OF NEW ARTICLES

The Company’s existing Articles (the “Existing Articles”) were implemented on May 30, 1986 pursuant to the Old Act. Since that time, a number of amendments have been made to the Corporations Act and certain corporate practices have evolved which are not reflected in the Existing Articles.

Accordingly, the Directors are recommending that the Company adopt a new form of Articles (the “Revised Articles”) to incorporate the provisions reflected in the amendments to the Act and to facilitate the Company being able to take advantage of certain mechanisms permitted by the legislation.

Key Provisions of Revised Articles

The following is a summary of certain key provisions contained in the Revised Articles that represent a change from the Existing Articles:

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

A copy of the Revised Articles is attached as Appendix “B” to this Proxy Statement.

6

The resolution to adopt the Revised Articles must be passed by not less than 75% of the votes cast by the shareholders present in person or by proxy at the Meeting. Accordingly, the Company’s shareholders will be asked to consider and, if thought advisable, to pass, with or without amendment, a special resolution as follows:

“BE IT RESOLVED, as a Special Resolution, THAT:

| ||

|

BDO CANADA LLP AS GOLDEN QUEEN'S INDEPENDENT AUDITORS FOR THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADOPTION OF NEW ARTICLES OF THE COMPANY.FISCAL YEAR ENDING DECEMBER 31, 2011.

PROPOSAL 3

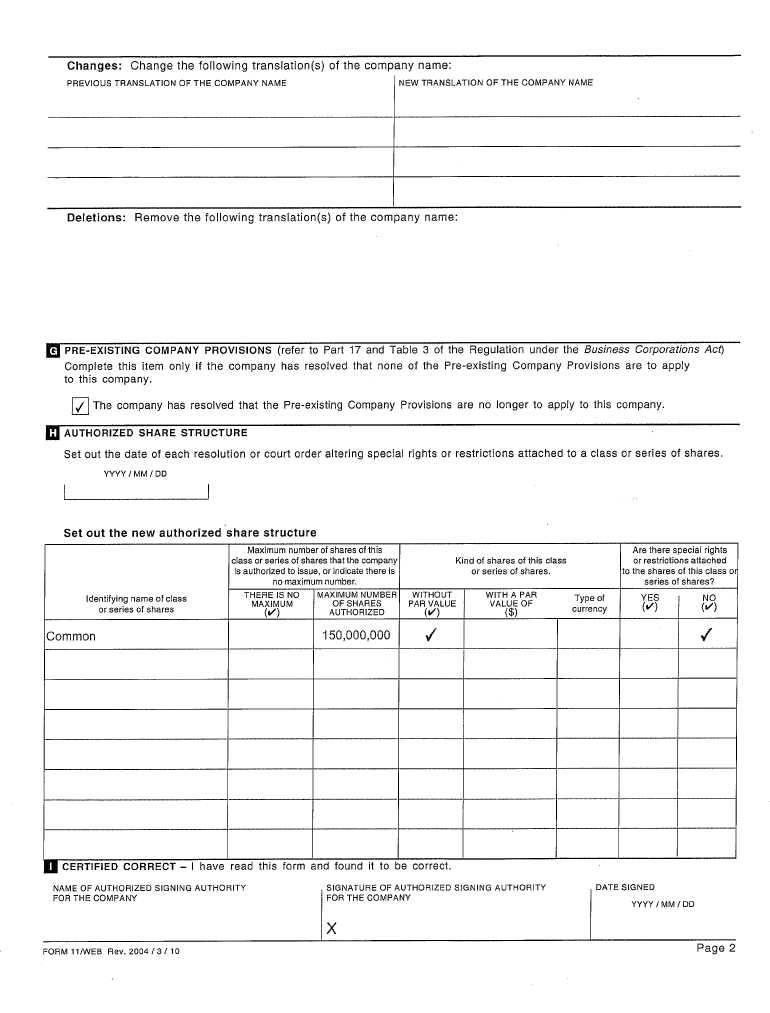

INCREASE OF AUTHORIZED CAPITAL

The Company proposes to alter its Notice of Articles to increase the Company’s authorized capital from 100,000,000 common shares without par value to 150,000,000 common shares without par value. The Company previously had also authorized 3,000,000 preferred shares without par value, however as no preferred shares are presently outstanding, no preferred shares will be included in the proposed alteration.

The Company currently has no specific proposals or agreements for offers or sales of its common shares. The Company expects that costs associated with developing a mine at its Soledad Mountain project may require additional equity financing. Any mine project financing or series of financings could result in the allotment of additional common shares that would exceed the Company’s current authorized capital. Accordingly, the Company believes that it is prudent to increase the authorized capital at this time.

The rights, privileges, preferences and restrictions applicable to the Company’s common shares will not be affected by the proposed change to the authorized capital. There are currently no provisions in the current or Revised Articles or agreements to which the Company is a party or is aware of, or any other facts or circumstances, that would give the Company a basis to conclude that the increase in authorized capital would have the effect of delaying, deferring or preventing a potential change in control.

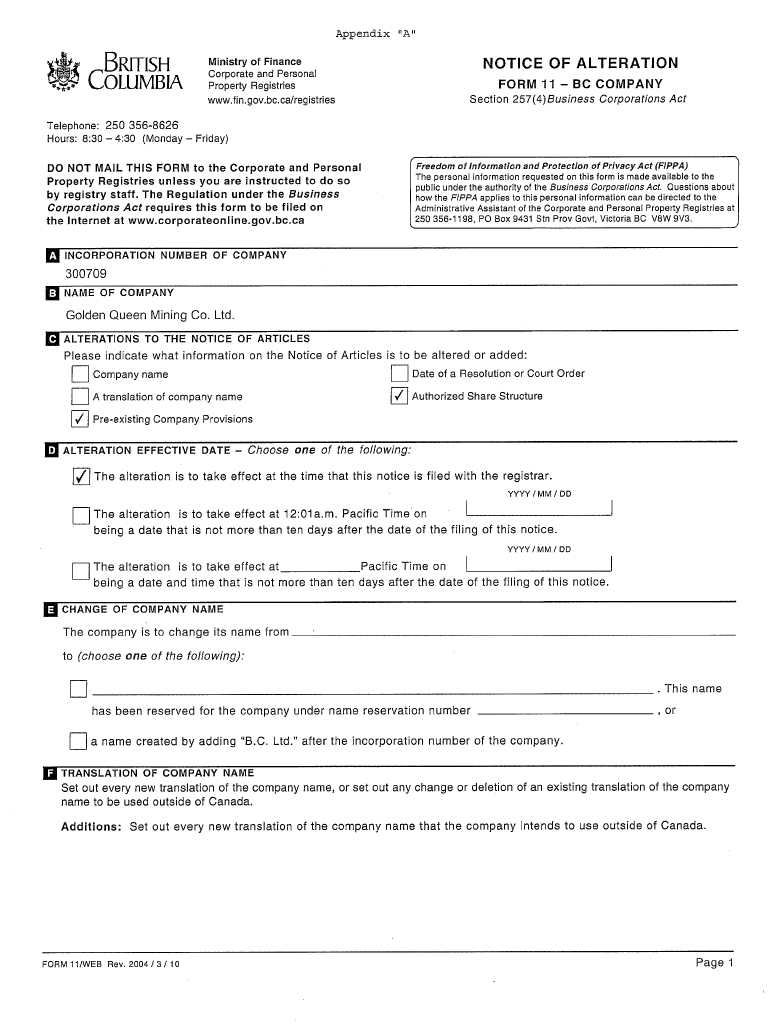

If shareholders of the Company approve the proposal to change the Company’s capital structure, the Company will file a Notice of Alteration, in the form attached hereto as Appendix “A”, with the British Columbia Registrar of Companies implementing the change in the Company’s capital structure.

The resolution to increase the authorized capital must be passed by not less than 75% of the votes cast by the shareholders present in person or by proxy at the Meeting. Accordingly, the Company’s shareholders will be asked to consider and, if thought advisable, to pass, with or without amendment, a special resolution as follows:

“BE IT RESOLVED, as a Special Resolution, THAT:

| ||

| ||

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” INCREASING THE AUTHORIZED CAPITAL OF THE COMPANY TO 150,000,000 COMMON SHARES.

7

OTHER MATTERS

Golden Queen knows of no other matters that are likely to be brought before the Meeting. If, however, other matters not presently known or determined properly come before the Meeting, the persons named as proxies in the enclosed proxy card or their substitutes will vote such proxy in accordance with their discretion with respect to such matters.

PROPOSALS OF SHAREHOLDERS

Meeting Materials sent to Beneficial Owners who have not waived the right to receive Meeting Materials are accompanied by a Voting Instruction Form (“VIF”). This form is instead of a proxy. By returning the VIF in accordance with the instructions noted on it, a Non-Registered Holder is able to instruct the Registered Shareholder how to vote on behalf of the Non-Registered Shareholder. VIF’s, whether provided by the Company or by an Intermediary, should be completed and returned in accordance with the specific instructions noted on the VIF.

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the shares which they beneficially own.Non-Registered Holders receiving a VIF cannot use that form to vote common shares directly at the Meeting - Non-Registered Holders should carefully follow the instructions set out in the VIF including those regarding when and where the VIF is to be delivered.Should a Non-Registered Holder who receives a VIF wish to attend the Meeting or have someone else attend on his/her behalf, the Non-Registered holder may request a legal proxy as set forth in the VIF, which will grant the Non-Registered Holder or his/her nominee the right to attend and vote at the Meeting.

Proposals which shareholders wish to be considered for inclusion in the Proxy Statement and proxy card for the 20112012 Meeting of Shareholders must be received by the Secretary of Golden Queen by December 1, 2010,2011, and must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, and Division 7 of Part 5 of the B.C. Business Corporations Act.

ANNUAL REPORT ON FORM 10-K

A COPY OF GOLDEN QUEEN’S COMBINED ANNUAL REPORT TO SHAREHOLDERS AND ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2010 ACCOMPANIES THIS PROXY STATEMENT AND IS IN THE FORM ANNEXED TO THE PROXY STATEMENT AS APPENDIX “A”. AN ADDITIONAL COPY WILL BE FURNISHED WITHOUT CHARGE TO BENEFICIAL SHAREHOLDERS OR SHAREHOLDERS OF RECORD UPON REQUEST TO INVESTOR RELATIONS, GOLDEN QUEEN MINING CO. LTD. AT 6411 IMPERIAL AVENUE, WEST VANCOUVER, BC, V7W 2J5.

Dated at Vancouver, British Columbia, this 312rdthday of August, 2010.May, 2011.

8BY ORDER OF THE BOARD OF DIRECTORS

/s/ H. Lutz Klingmann

H. Lutz Klingmann

President

21

Appendix “B”

Incorporation Number:BC0300709

ARTICLES

OF

GOLDEN QUEEN MINING CO. LTD.

MORTON & COMPANY

Page 1 of 41

MORTON & COMPANY

Page 2 of 41

MORTON & COMPANY

Page 3 of 41

MORTON & COMPANY

Page 4 of 41

MORTON & COMPANY

Page 5 of 41

PROVINCE OF BRITISH COLUMBIA

Business Corporations Act

Articles of “Golden Queen Mining Co. Ltd.”(the “Company”)

1.INTERPRETATION

1.1Definitions

In these Articles, unless the context otherwise requires:

| ||

| ||

| ||

| ||

| ||

| ||

|

1.2Business Corporations Act and Interpretation Act Definitions Applicable

The definitions in theBusiness Corporations Act and the definitions and rules of construction in theInterpretation Act, with the necessary changes, so far as applicable, and unless the context requires otherwise, apply to and form a part of these Articles. If there is a conflict between a definition in theBusiness Corporations Act and a definition or rule in theInterpretation Act relating to a term used in these Articles, the definition in theBusiness Corporations Act will prevail in relation to the use of the term in these Articles. If there is a conflict or inconsistency between these Articles and theBusiness Corporations Act, theBusiness Corporations Act will prevail.

2.SHARES ANDSHARECERTIFICATES

2.1Authorized Share Structure

The authorized share structure of the Company consists of shares of the class or classes and series, if any, described in the Notice of Articles of the Company.

MORTON & COMPANY

Page 6 of 41

2.2Form of Share Certificate

Each share certificate issued by the Company shall be in such form as the directors may determine and approve and must comply with, and be signed as required by, theBusiness Corporations Act.

2.3Shareholder Entitled to Certificate or Acknowledgment

Shares may be issued without a share certificate or written acknowledgment. Upon request, however, each shareholder is entitled, without charge, to (a) one share certificate representing the shares of each class or series of shares registered in the shareholder’s name or (b) a non-transferable written acknowledgment of the shareholder’s right to obtain such a share certificate, provided that in respect of a share held jointly by several persons, the Company is not bound to issue more than one share certificate or acknowledgement and delivery of a share certificate or acknowledgement to one of several joint shareholders or to a duly authorized agent of one of the joint shareholders will be sufficient delivery to all.

2.4Delivery by Mail

Any share certificate or non-transferable written acknowledgment of a shareholder’s right to obtain a share certificate may be sent to the shareholder by mail at the shareholder’s registered address and neither the Company nor any director, officer or agent of the Company is liable for any loss to the shareholder because the share certificate or acknowledgement is lost in the mail or stolen.

2.5Replacement of Worn Out or Defaced Certificate or Acknowledgement

If the directors are satisfied that a share certificate or a non-transferable written acknowledgment of the shareholder’s right to obtain a share certificate is worn out or defaced, they must, on production to them of the share certificate or acknowledgment, as the case may be, and on such other terms, if any, as they think fit:

| ||

|

2.6Replacement of Lost, Stolen or Destroyed Certificate or Acknowledgment

If a share certificate or a non-transferable written acknowledgment of a shareholder’s right to obtain a share certificate is lost, stolen or destroyed, a replacement share certificate or acknowledgment, as the case may be, must be issued to the person entitled to that share certificate or acknowledgment, as the case may be, if the directors receive:

| ||

|

2.7Splitting Share Certificates

If a shareholder surrenders a share certificate to the Company with a written request that the Company issue in the shareholder’s name two or more share certificates, each representing a specified number of shares and in the aggregate representing the same number of shares as the share certificate so surrendered, the Company must cancel the surrendered share certificate and issue replacement share certificates in accordance with that request.

MORTON & COMPANY

Page 7 of 41

2.8Certificate Fee

There must be paid to the Company, in relation to the issue of any share certificate under Articles 2.5, 2.6 or 2.7, the amount, if any and which must not exceed the amount prescribed under theBusiness Corporations Act, determined by the directors.

2.9Recognition of Trusts

Except as required by law or statute or these Articles, no person will be recognized by the Company as holding any share upon any trust, and the Company is not bound by or compelled in any way to recognize (even when having notice thereof) any equitable, contingent, future or partial interest in any share or fraction of a share or (except as required by law or statute or these Articles or as ordered by a court of competent jurisdiction) any other rights in respect of any share except an absolute right to the entirety thereof in the shareholder.

3.ISSUE OFSHARES

3.1Directors Authorized

Subject to theBusiness Corporations Act and the rights, if any, of the holders of issued shares of the Company, the Company may issue, allot, sell or otherwise dispose of the unissued shares, and issued shares held by the Company, at the times, to the persons, including directors, in the manner, on the terms and conditions and for the issue prices (including any premium at which shares with par value may be issued) that the directors may determine. The issue price for a share with par value must be equal to or greater than the par value of the share.

3.2Commissions and Discounts

The Company may at any time pay a reasonable commission or allow a reasonable discount to any person in consideration of that person purchasing or agreeing to purchase shares of the Company from the Company or any other person or procuring or agreeing to procure purchasers for shares of the Company.

3.3Brokerage

The Company may pay such brokerage fee or other consideration as may be lawful for or in connection with the sale or placement of its securities.

3.4Conditions of Issue

Except as provided for by theBusiness Corporations Act, no share may be issued until it is fully paid. A share is fully paid when:

| |||

| |||

| |||

| |||

MORTON & COMPANY

Page 8 of 41

|

3.5Share Purchase Warrants and Rights

Subject to theBusiness Corporations Act, the Company may issue share purchase warrants, options and rights upon such terms and conditions as the directors determine, which share purchase warrants, options and rights may be issued alone or in conjunction with debentures, debenture stock, bonds, shares or any other securities issued or created by the Company from time to time.

4.SHAREREGISTERS

4.1Central Securities Register

The Company must maintain a central securities register in accordance with the provisions of theBusiness Corporations Act. The directors may, subject to theBusiness Corporations Act, appoint an agent to maintain the central securities register. The directors may also appoint one or more agents, including the agent which keeps the central securities register, as transfer agent for its shares or any class or series of its shares, as the case may be, and the same or another agent as registrar for its shares or such class or series of its shares, as the case may be. The directors may terminate such appointment of any agent at any time and may appoint another agent in its place.

4.2Closing Register

The Company must not at any time close its central securities register.

5.SHARETRANSFERS

5.1Private Issuer Restrictions

The provisions of Article 27 shall apply to any proposed transfer of a share of the Company.

5.2Registering Transfers where Certificate or Acknowledgement

A transfer of a share of the Company for which a share certificate has been issued or for which the shareholder has received a non-transferable written acknowledgment of the shareholder’s right to obtain a share certificate must not be registered unless the Company or the transfer agent or registrar for the class or series of share to be transferred has received:

| ||

|

MORTON & COMPANY

Page 9 of 41

| ||

|

5.3Registering Transfers where no Certificate or Acknowledgement

A transfer of a share of the Company for which a share certificate has not been issued or for which the shareholder has not received a non-transferable written acknowledgment of the shareholder’s right to obtain a share certificate (for example, where shares are issued in book-only form), must not be registered unless the requirements for transfer as approved by the directors have been met.

5.4Form of Instrument of Transfer

The instrument of transfer in respect of any share of the Company must be either in the form, if any, on the back of the Company’s share certificates or in any other form that may be approved by the directors from time to time.

5.5Transferor Remains Shareholder

Except to the extent that theBusiness Corporations Act otherwise provides, the transferor of shares is deemed to remain the holder of the shares until the name of the transferee is entered in a securities register of the Company in respect of the transfer.

5.6Signing of Instrument of Transfer

If a shareholder, or his or her duly authorized attorney, signs an instrument of transfer in respect of shares registered in the name of the shareholder, the signed instrument of transfer constitutes a complete and sufficient authority to the Company and its directors, officers and agents to register the number of shares specified in the instrument of transfer or specified in any other manner, or, if no number is specified, all the shares represented by the share certificates or set out in the written acknowledgments deposited with the instrument of transfer:

| ||

|

5.7Enquiry as to Title Not Required

Neither the Company nor any director, officer or agent of the Company is bound to inquire into the title of the person named in the instrument of transfer as transferee or, if no person is named as transferee in the instrument of transfer, of the person on whose behalf the instrument is deposited for the purpose of having the transfer registered or is liable for any claim related to registering the transfer by the shareholder or by any intermediate owner or holder of the shares, of any interest in the shares, of any share certificate representing such shares or of any written acknowledgment of a right to obtain a share certificate for such shares.

MORTON & COMPANY

Page 10 of 41

5.8Transfer Agent

The Company may appoint one or more trust companies or agents as its transfer agent for the purpose of issuing, countersigning, registering, transferring and certifying the shares and share certificates of the Company.

5.9Transfer Fee